Sometime back, PCI-DSS published the Top 10 Myths of PCI-DSS which we debunked in our series of Myths of the Top 10 Myths here. In this article, we are going to jump into the real actual Myths of PCI-DSS and we will explain it as we go along. We are not going to touch on the original myths published by PCI Council, but this is really very much based on our experience in PCI-DSS for more than a decade here in Malaysia, and what we often hear companies going about.

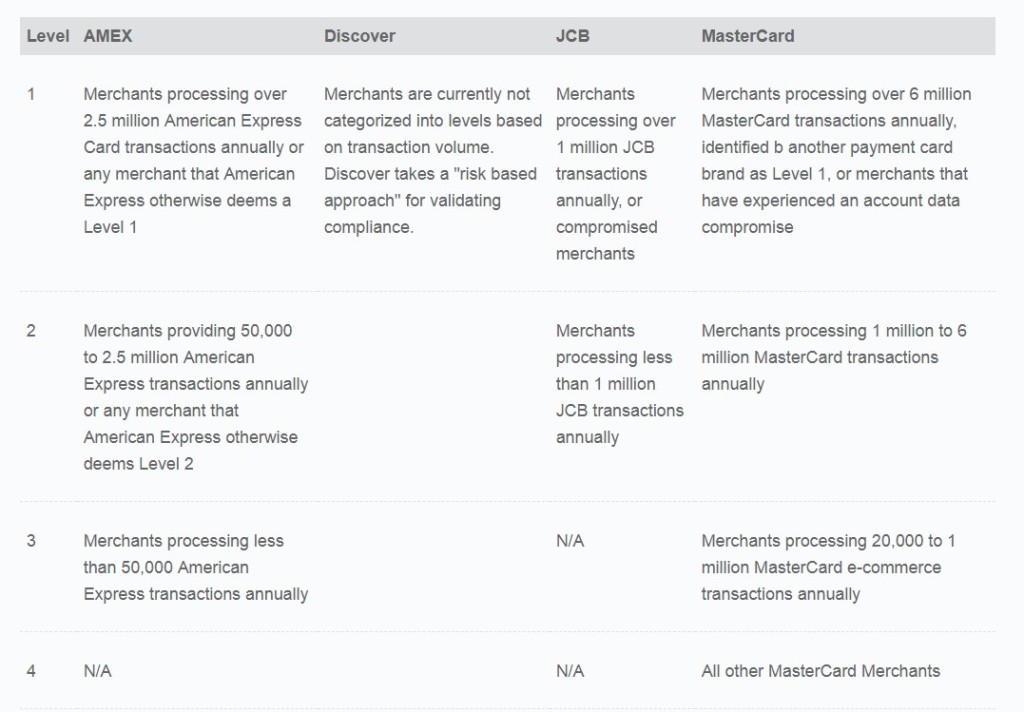

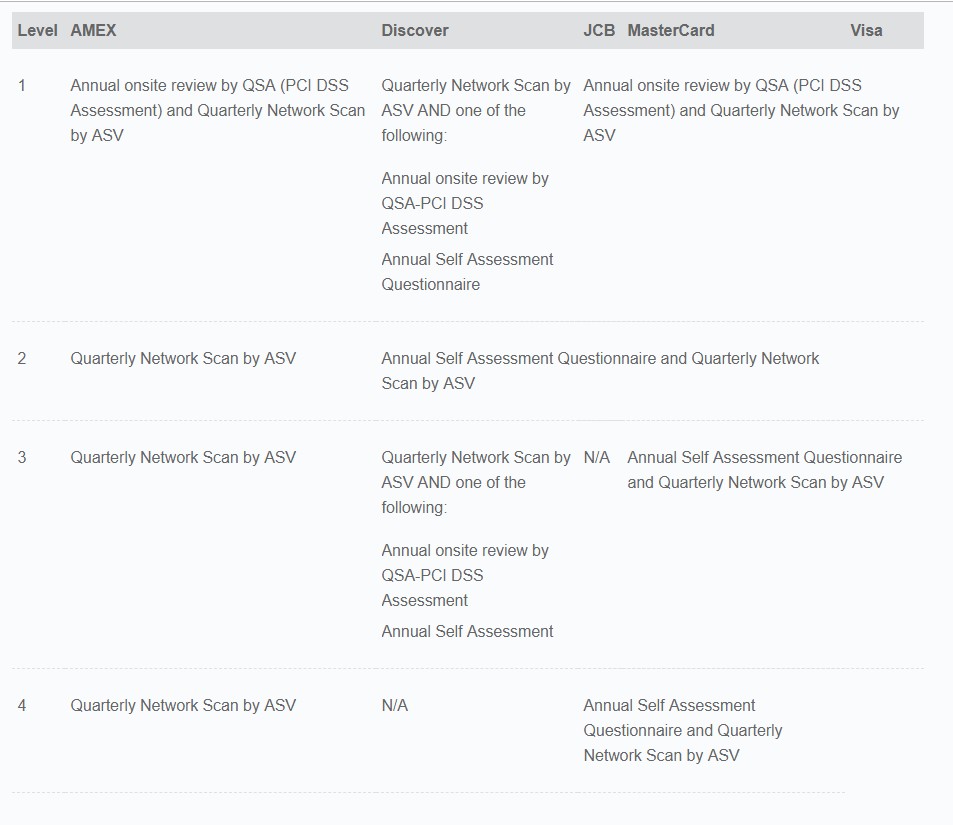

Often this misinformation is because the client facing PCI-DSS finds it hard to dissect all the information needed for the standard. Unlike standards like ISO27001, PCI-DSS is like a journey with different routes to the same destination: PCI Compliance. There are 3 separate destination for PCI – Level 1 Certified with QSA, Level 2 Self Assessment with QSA/ISA signoff, and Level 2 Self Assessment with Self Sign off (no QSA, no ISA signoff). Of course if you are a merchant, then you have level 3 and level 4, but those are the same as the third iteration where you signoff the SAQ on your own without involvement of QSA/ISA.

But while the destination itself can be clarified, the whole process to obtain PCI can be convoluted. Some clients are told by their banks, that because they do not store credit card, they are considered SAQ level 2. Or some are told because they have a website, they must do ASV scans. Or some are told that QSAs must be involved in everything. Some are even told, that local QSAs must be hired, and not any other QSAs. Some are of the opinion that PCI is a license they need to purchase, or a training they need to do. And some are of the opinion that the ASV scan will make them PCI compliant.

Hence, it’s easy with all the above misinformation and more, that customers get frustrated with the expectations of PCI. When they hear a level 1 certification may set them back 15 – 20K USD or more, or that it would take them 6 months or so, they balk at it. It’s funny because often I would start my sales pitch by saying: “At the end of our conversation, it would be goal to try to get you to avoid getting services from us if possible.” Because it’s essentially true. Our job at the beginning isn’t to peddle services or consulting or audit that our clients may not need. Our goal is to provide them with enough information of PCI-DSS so they can make informed decisions. And yes, even if those informed decisions would be that they can avoid PCI, or do their own SAQ without any consultation or ASV scans or certification, or get exemption from their banks/customers or anything else that can lower their requirements for PCI-DSS. And yes, many people who have called us actually just pay us by saying ‘thank you’ and we never hear from them again. Because as advisors, it’s better we start doing the right thing at the very beginning instead of focusing to sell services that customers do not need. This philosophy has been adopted from the start of our company – which is one of the reasons why I failed so miserably in my previous corporate role as regional head of professional service sales. Or also why I was once told off by a potential business partner that I was a poor sales person and that he preferred to work with an organisation with someone better handling sales. Ah well.

So here are some of the top REAL myths of PCI-DSS that needs to be debunked, burned, destroyed and thrown out of the window for the garbage that it is.

1) All PCI-DSS Projects Require ASV Scans

2) ASV scans makes you PCI compliant

3) All PCI-DSS requires (local) QSA

4) All PCI projects are the same (One Certificate to Rule them All)

5) All PCI-DSS services must be outsourced

6) All service providers MUST be certified to do implementation services

7) PCI scope and application of controls can be determined by the customer

8) PCI-DSS gets easier and cheaper every year

9) A company is considered PCI compliant even after the expiry of certification, due to 90 days grace period from the council

10) If the company is an ISMS certified company, they have already complied to 90% of PCI-DSS

So there is quite a bit of stuff – some may be half truths and other are utter nonsense – we need to uncover, likely will need to break this article up into two parts. Let’s jump into it.

Real Myth 1: All PCI-DSS projects require ASV scans

This myth is often peddled by those who are selling ASV scans as part of their service. Don’t get me wrong, we also do ASV scans through our ASV partners for sure, but you can’t go around town telling people that all PCI requires ASV scans when it doesn’t! Read SAQ A. Read SAQ B. You don’t see ASV being mentioned anywhere in the SAQ except for this portion in Part 3a:

ASV scans are being completed by the PCI SSC Approved Scanning Vendor (ASV Name)

And under “PCI DSS Self-Assessment Completion Steps”:

Submit the SAQ and Attestation of Compliance (AOC), along with any other requested documentation—such as ASV scan reports—to your acquirer, payment brand or other requester.

The thing is, if you go through each control under the SAQ, the ASV control 11.2.2 isn’t mentioned, so therefore it’s not required. It’s highly frustrating to us, especially when travel agencies for instance who are just doing EDC terminal business (SAQ B) that connects directly via cellular or phone line to acquirer coming to us and asking us to quote for an ASV scan for their website. We tell them, you don’t need to do ASV scan for your website unless its in scope. You can force us to sell to you, but it’s against our moral code to sell you stuff you don’t need. We take a look at it, find its a simple site with only information and they tell us, “Well, their PCI advisor previously told them to scan their website.” No. You don’t need to. Don’t waste your money, and don’t do it unless you have a website in scope or you are doing an SAQ requiring ASV scan or you consciously make a decision to do it out of best practices and security requirement – NOT as a mandatory PCI-DSS activity.

So, please, take a look. Even SAQ A, usually adopted by e-commerce sites that redirects to a payment gateway for card input – where there is likely a website, the myth is that ASV needs to be done. Read SAQ A. Again, no requirement for ASV scan. You can still do an external scan for security purpose, but strictly for compliance? No. Not needed, unless requested specifically by the acquirer.

And yes, we do have ASV scans as part of our service. But that shouldn’t make us charlatans peddling services to customers when it isn’t mandatory. If the client still wants to pick it up, ok, fine – but don’t say it’s compulsory when it’s not!

Real Myth 2: ASV scans makes you PCI compliant

We have flogged this one half to death in our earlier article here: ASV scans=/ PCI Compliance

I won’t repeat what we have said there but by far, this is a myth that gets peddled a lot. One, sadly, is because the propagation of this nonsense seems to be acceptable by banks. I hear: “Oh, no problem, the bank says all we need to do is to run an ASV scan on our website.” I interject: “Wait sir, you aren’t doing that e-commerce business. You are doing a call center with virtual terminal payments..” <Click> <Dial tone due to hang up>

So there you have it : companies and merchants that have no business doing ASV scans , but using ASV scans as a means to ascertain PCI compliance. We get this even weirder ones when we are trying to obtain an AoC from one of our client’s service providers and they pass us their passed ASV scan report. We ask what the heck that is and they go – that’s our PCI compliance, so please shut up and stop bothering us. And it’s so difficult to go out and explain to them that whoever told them that, is wrong, and they have to go through the actual PCI compliance, which their wonderful ASV scan may (or may not) be part of that overall PCI Compliance.

Real Myth 3: The Auditor (QSA) must be Local

This is one of the strangest myths ever.

We get calls from customers going, “Is your QSA a Malaysian?” And I go, “No, we work with our partner QSA, from India, US or Singapore”. And they go, “Well we want a Malaysian QSA.” And I ask, “Why?”, and most of them are not able to ascertain why they need the QSA to be local, except that it may be a requirement checkbox in their document or policy.

Ok, I can’t argue with your policy, if you have nationalist preferences to your auditors for whatever reason. But it’s not logical for companies to have that requirement, that only local QSAs must be used. PCI-DSS never stated that. In fact, its preferable to have a QSA with regional/global experience as opposed to a local QSA. If PCI-DSS had this requirement for local QSAs to carry out audits, how can QSAs then say they have ‘regional experience’? You see the conundrum? You want an experienced QSA company, yet you want a QSA that is only local. If every enterprise in the world thinks that way, how would QSAs have regional/global experience? By that argument, then all QSAs would be local to that country – not just Malaysia – but each country would only have QSAs auditing in that country and nowhere else. And immediately you can see the fallacy and illogical argument attached to this myth. But this myth still prevails, for whatever reason (we sort of know the reason actually).

PCI-DSS requires a lot of experience. The last thing we need is a QSA with only a handful of experience and no operational idea of how to run things or recommend solutions and just rely on a checkbox and some cute marketing gimmicks. I’ve seen plenty of good auditors overseas, a whole lot better than the local ones I come across and vice versa. “Local QSA requirement?” It could be peddled by local auditors attempting to block off better equipped, or even cheaper auditors from overseas (better or worse) and really narrowing the options for their clients, who would be hemmed in by such requirement, thinking its a PCI-DSS requirement. It’s not.

If you mean by local support- that they can respond faster since they are local, then, yes, there is some sense in that. If you mean they are cheaper compared to a guy in US, then yes, but let that be a commercial decision and not a technical one. Sometimes even overseas (good) QSAs can be cheaper. Local support I agree, 100%. Nothing is more frustrating than sending a message to someone and them taking 24 hours to reply due to them being in another timezone. Local presence, local support – yes. But they technically don’t need to be a QSA. They could be consultants and there is a very good case in that. We noted it here in this article “PCI-DSS – So Why Aren’t We QSA?”. We consciously made a decision NOT to be a local QSA a few years ago to avoid possible conflict and to support our clients a lot easier and not to be bogged down by auditor responsibilities in PCI.

QSAs are a busy and itinerant lot. Aside from handling other audits, writing reports, they also need to be careful of overstepping their independent role by advising and implementing for their clients and then auditing this same control they devised.

There is really, if you come down to it, no perceivable value in saying having a “local QSA” is better or not. Having local support throughout the PCI-DSS compliance is important – and whoever is supporting should have at least the same or more knowledge than the QSA.

In some QSA Companies, they have a set up to differentiate the auditor and the consultant. Whereby the consultant is different from the auditor to ensure there is more independence. We have the same set up – PKF is the consulting arm and we deal mainly with implementation, testing and assistance of our client to get past PCI. The QSA is well, the QSA in this case, and they can do their audit without being too involved in the implementation. We know as much (and if not more, sometimes) than the QSA due to our operational experiences, and this puts us in a better position – conflict free- to get our clients certified.

So, no, in this opinion, there is no real value or even PCI requirement in having a local QSA, because that generally does not make sense and is counter-intuitive to peg a customer to only select local, less experienced auditors. Most QSAs can (and should) be able to do regional or even inter-regional work because a QSA Company, by its very nature is a regional or global company anyway (QSA pays to be auditors based on regions, and not country specific). Again, while our opinion may be biased because of the strategic decision we made years ago, we made that decision with all these considerations in mind.

Select the best QSA option based on experience, pricing and quality, not because they are local or non-local.

Real Myth 4: All PCI projects are the same (One Certificate to Rule them All)

A customer once said that we didn’t have much value and all we did was to forward their emails to the QSA for validation (not true). He said he had his team done PCI across other countries and we were just making it more complicated than necessary since they have already been experienced, implying that we hoodwinked them.

It’s very difficult to talk to people who are in this position because you can see from the onset, they do not support outsourcing advisory and consulting and they have a personal vendetta against this profession. So we don’t need to speak reason to them. In this case, we decided to pull out of the deal for advisory and all other works of implementation except for the ASV scans.

Two years from starting their PCI project on their own, and they are still in the wilderness. We ended up supporting them in any case, and perhaps their thought process had somewhat soften now because we are now finally seeing the end of the project, with us (ironically) leading them to it.

And their ‘experience’ from other PCI compliance projects? Different experience. Some were basically e-commerce SAQ A, A-EP type, some were their retail arm SAQ B or B-IP. But what they were doing in Malaysia was the outsourcing, call center and BPO – all of which involves credit card storage, processing and transmission.

Not all PCI-DSS projects are created equal.

Another company employed the ‘One Certificate to Rule Them All’ philosophy. They were providing warehouse storage facility to one of our clients, essentially storing physical copies of forms containing credit card information. So, this is a service provider, providing storage that needs to be assessed for their physical security.

They immediately told us they are already PCI compliant and they will send us the certificate. We insisted on AoC but they obliged us with their ‘certificate’ anyway, emblazoned with their QSA logo proudly, stating – SAQ C-VT Certified.

Huh? What has SAQ C-VT (merchant SAQ) got to do with the warehouse storage you are offering to my client?

Apparently that SAQ C-VT cert is from one of their parent companies overseas or something and has as much relation to our current project as me running to become the president of the United Sates. It means, One Certificate 100% does not rule them all. It’s a completely different business function and you can’t just use another SAQ or AoC from another parent/child company that is selling ice-cream cakes and had their call agent processes certified and say this applies to your warehouse storage facility half a world away!

Ok, we are halfway there, bear with us. Writing all these myths really can drag an article and you can probably read the frustration oozing out each paragraph. I’ll admit, we get extremely frustrated, but we also must remind ourselves – most of them (customers, banks – NOT QSAs, they don’t get any free passes for giving misinformation!) do not know better and they are just doing what they think it’s right or what they have been told by so called consultants or QSAs. That’s why we need to set their paths correctly so they know what options are there before them. So, we need to stop getting frustrated and blaming them for bad decisions, and get more involved in educating and providing information so they can make good decisions.

We will continue the next time once we catch our breath and go through the other wonderful misinformation on PCI-DSS we have heard over the years. Till then, drop us a note at pcidss@pkfmalaysia.com on anything to do with this standard or other standards like ISMS/ISO27001 etc.