While a good part of our PCI business is providing level 1 certification to service providers, we also have provided the same to Level 1 merchants. Where we are seeing a big need for advisory is in the Level 2 Service Providers, or the Level 2,3,4 Merchants. This is because they generally fall under the SAQ category. SAQ = Self Assessment Questionnaire.

Now, I am not going document what these SAQs are, or their individual applicability and requirements – there are 2,345,565 sites so far that do this, so go ahead and google it – these sites do a great job in presenting the SAQs in a far more structured manner.

What we are going attempt to do here is jump right into it with the assumption you have some familiarity with these SAQs and you are as frustrated as most of our clients with it and want to find out why these SAQs suck so bad.

Well, mainly, there are a lot of ’em. PCI-DSS isn’t a guideline or framework like ISMS/COBIT. It’s a bunch of standards (some excellent in terms of making sense, some not so) that range from ‘oh that’s easy’ to ‘That is going to cost me a bomb’ sort of thing. So, different SAQs apply to different business. Each type of business have somewhat a different journey in PCI – the online mall with e-commerce vs the restaurant chain that has 100 branches nationwide etc.

We are going to focus where most the confusion happens: The SAQ A vs SAQ A-EP. Note that these SAQs apply to mainly e-commerce customers. So if you are doing mainly e-commerce business (we can go into POS issues later) – then it’s either SAQ A, SAQ A-EP or SAQ D-MER.

Now there’s a bit of history here – previously e-commerce companies that do online transaction with credit cards have two choices: SAQ A – which has a breezy 14 or so questions (now updated to around 20) or SAQ D – which jumps to the full monty, i.e 300++ questions covering the full 12 requirements of PCI. There is no middle ground. It’s like you are doing a weekend hike up your neighbourhood hill with your 5 year old son and suddenly someone tells you you are climbing up Mount Everest next. You can imagine merchants doing two things: they tear their hair out doing the SAQ D, or they just work on SAQ A, whether they qualify or not. More on the qualifying later.

So now, recently in the newer versions, PCI says, “Aha, let’s give these guys a break by introducing SAQ A-EP”. The ‘EP’ here stands for Ecommerce Payment, we assume. The problem here is that PCI Council, while trying their best to clarify who can or cannot be SAQ A, A-EP or D, only serves to make things even more confusing.

Your goal – if you are an e-commerce merchant – is to do your best to end up with SAQ A. Because it is the easiest. More importantly, it’s the cheapest. You don’t need to do any ASV scans, or pentest or all the kebabs that come with doing SAQ A-EP or SAQ D. The list of questions in the recent version increases from 20 to around 190 to 340+, when you go from A -> A-EP -> D-MER. That’s a difference between a days work to probably one to two months to a full five to six months.

PCI generally have a lot of documentation on SAQ A and A-EP and when to use it etc.We have provided a few good links below the article.

PCI generally slice the e-commerce implementations into 4 broad categories and in a layman description below: (for more technical explanation, google the words below with PCI appended to it and there should be some good sites coming up that explain in more detail):

a) Redirect – SAQ A

When you (customer) click on checkout with credit card after selecting your favourite golf clubs to buy (or high heels, whichever your fancy), you suddenly get a message saying, exiting www.ecommercemerchant.com, redirecting to PaymentProcessorName. This usually is a popup, or if not, another tab, or just a pure redirect. Now you see another page stating its the payment processor, and here is where you enter your card details (name, PAN, CVV etc). After entering, and being authorised, you are dropped back into the merchant page. The merchant has no idea of anything you have typed into the payment page.

b) IFRAME – SAQ A

Not as common, at least in our experience. This is when we click checkout with credit card, the page is still with the ecommerce merchant, but an iframe is loaded. An iframe is basically a page within a page, a child page that belongs to another site. It’s like a dream within a dream concept from Inception. So the merchant page now loads the payment processor page WITHIN its own page. The entire code for iframe is controlled by the payment processor. Even the code to Call the iframe is given by the processor. As far as the merchant is concerned, it’s like a redirect, a sleight of hand, it’s prestidigitation! (In the words of OZ). This is advantageous from a customer experience perspective as the customer feels that they are still with the merchant instead of being sent to another shop to make payment. The problem is, like everything, IFRAME is hackable. Here is a good rundown recently of an IFRAME hacking incident.

c) Direct Post – SAQ A-EP

OK – this is the one we see most (aside from the first). A lot of customers think they are doing a), when in fact they are doing c). Basically the form where we type in our Payment information is sitting with the merchant, and once we click submit, then it connects to the payment gateway and sends all the information. The payment detail collection page sits with the merchant.

d) Javascript – SAQ A-EP

We hardlysee this around, but even if we do, and if we are not firing up our developer tools, we probably won’t know. Basically, when we load the payment page on the merchant website, the processor page talks directly to us, the customer. The processor sends Javascript to our browser and our browser magically creates the payment form, which we happily fill in and send it back to the processor. Generating via Javascript has its advantages – dynamically it can fill in some parts of the form depending on where the client is, or basically improve the user experience overall. But again, a malicious code can be executed instead and instead of sending over to the payment processor, you might end up sending over to your friendly neighbourhood hacker.

The other scenarios falls into the bottom catch-all of SAQ D.

The confusion is added when in the SAQ A-EP document, it states: “Your e-commerce website does not receive cardholder data but controls how consumers, or their cardholder data, are redirected to a PCI DSS validated third-party payment processor”

So my question is, wouldn’t the fact that the merchant site is controlling the iFrame code or the actual redirection make it fall under “Controls how consumers are redirected” caveat there? It does. So much so that PCI Council issued a statement here at their FAQ site: https://www.pcisecuritystandards.org/faqs. Just type in “1292” and you should see the article reproduced.

Basically they go a long about way saying that yes, they understand that iFrame and Redirect falls under that SAQ A-EP caveat but they are willing to allow SAQ A to be used in this circumstances because “in the payment brands’ experience these are detected before significant volumes of cardholder data are lost. The Council is working with Payment Service Providers to encourage tamper-resistance and tamper-detection which will also reduce the viability of a MITM-type attack.”

As we can see from the IFRAME hack, it’s not really that trivial to pull off as you do require some knowledge of the transaction ID and getting it from the payment processor. Like all man in the middle attack, it does take some skills to pull off and massive removal of credit card details is harder as each transaction ID is unique. It’s a lot easier getting a malware into a POS device and siphoning the credit card information there a’la Target breach a few years ago.

So you see, it really depends on how you code or implement your e-commerce site. We have seen many companies underscope themselves by doing SAQ A when actually they had to do SAQ A-EP. Worse, we have also seen some ecommerce merchants forced to go trough SAQ A-EP or even D when they can qualify for A. These are usually directed by their acquirers – either banks or gateways with little knowledge of SAQ and who somehow just randomly decide that all merchants must suffer through SAQ D. It’s like being jailed for 50 years for stealing an acorn from a squirrel. Maybe in Norway it’s a law, but it sure as heck not here!

And now we are seeing some really strange permutations coming from acquirers – some of our clients are told to do SAQ A, but must to ASV scans. What? If it’s SAQ A, it’s SAQ A. Done. Why ASV scans are needed? Oh – because the acquirer says so. Well, the PCI Council doesn’t say that, so what we are doing isn’t PCI requirement. And even one case whereby the company said, yes, the merchants need to do ASV – but hey, because their risk management approves it, only need to do twice a year, not four times a year. Wait – PCI still requires at least per quarter though.

And the best one we have heard in an RFQ so far – the requirement is to “ensure that company must get Level 1 certified and become member of PCI Council.”

Become a member of the PCI Council? How?

I don’t really blame the companies for misinterpreting actually. I mean, if you look at the amount of documents PCI forces us to go through, it’s like asking people to read War and Peace six times. In Russian. When you are not Russian.

So, it’s really our job, whether QSA, ASV, PCI-P or consultant, to generally stop, take a breath and try to get this PCI education going.

This is a long post. I haven’t even gone to live demo of actual sites doing the 4 things listed above (Redirect, Direct Post, IFRAME, Javascript). I usually do that during our PCI-DSS training but I will try to give some examples in the next few articles.

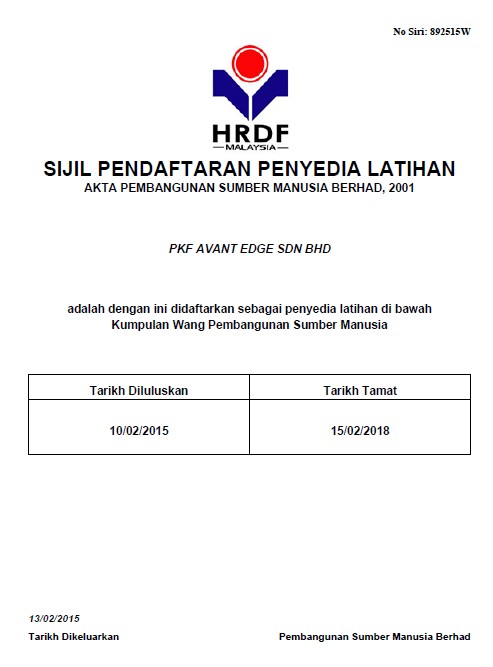

If you are interested in PCI-DSS training (HRDF claimable), a free PCI scoping or any PCI services like certification, ASV scans, penetration testing or generally dissecting the PCI-DSS novels you don’t want to read yourself – drop us an email at pcidss@pkfmalaysia.com and I guarantee we’ll pick it up.

No customer is too small (or big) for us to handle!

Here are some useful links on this topic:

c) PCIPortal

Good luck on your PCI journey!