Ah money.

This is how most conversations start when we receive calls from PCI. How much will it cost?

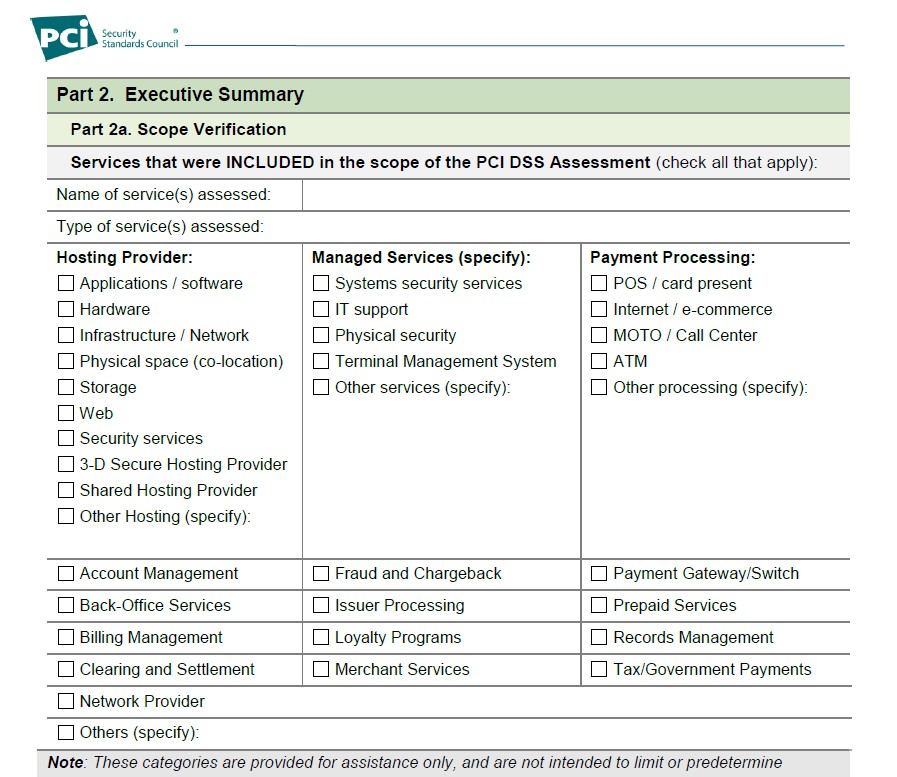

I think this is one of the toughest subject for PCI, because it really depends on what is being done by the service provider/consultant for you, and how much you can actually do the implementation of PCI-DSS on your own. And obviously it also depends on your scope, and on top of that, depends on compensating controls if any, or any current controls you have in place. And then it also depends on the validation type – SAQ vs RoC and so on.

So, in the classic riposte to this classic question, it would be “It depends”.

Where we really need to clear the air though is the myth that once you have done PCI-DSS the first time, everything gets easier on the renewals and everything gets cheaper year on year going forward. That is for another article. There is a lot of things going on in PCI-DSS, and if you approach it from a product perspective (like most procurement do), you end up either sabotaging your entire compliance, or getting an auditor willing to sign off on God knows what, and later on realise that you’ve been out of compliance scope all the while.

To start with the pricing, you should understand a bit on the cost of PCI-DSS. And we should start with the QSA, because after all they are the focal point of the PCI program. They are the Qualified Security Assessor. Of course, you can opt to do your PCI (if allowed) without a QSA involvement (Merchant level 3 or 4) and just fill up an SAQ with or without assistance from consultants; but for the most part, a QSA would be involved in the signoff for larger projects, and this is where the cost questions take life.

Lets look firstly at the base cost of becoming a QSA. It’s very helpfully listed for us here: https://www.pcisecuritystandards.org/program_training_and_qualification/fees

So here are the maths. Imagine you are a QSA with projects in Malaysia: to start off, you will need to set aside over RM100K just to get you qualified to to audits in the Asian Region. We’re not talking about Europe or Latin America or USA here. Just APAC. That’s qualifying the company. A company, to service any region properly will probably need a bunch of QSAs trained and ready, let’s say around 3 to start off with. Each QSA will need to go for a training costing around RM12 – 13K, so let’s say you have 3 (which is very few), you are setting aside around MYR 50K for that. On top of that, there are obligations such as Insurance Coverage that is specified in the QSA Qualifications Requirement document. So it depends on which insurance you are taking, but it could be in the region of around MYR6K or above premium (spitballing). There is a requalification each year as well.

QSAs then can make their own calculations on how fast/long they need to recover their cost, but let’s say they set aside 200K just to get things set up with 3 or 4 QSAs, then they need to recover that cost. A man day of a QSA/Consultant may range from quite widely in this region but let’s say you decide to price it at “meagre” MYR2K, depending on how senior you have, so overall, you would need to have almost around 1.5 months of engagement of their QSAs just to recover the cost of setting up shop. That’s why its not unreasonable to see higher rates, because of the cost it takes.

You have salaries to consider as well. You also have to consider if something happens to one of your clients, where you happily audited them remotely and believed everything they said, and found out that they have done jack-shoot in their actual environment and you have to handle the fallout of liabilities.

Some procurement compares QSA engagements to firewall engineers. No knock on other technical engineers, but the cost of getting a Checkpoint firewall engineer and the cost to maintain one QSA is a different proposition. I am not saying one is better than another technically (I’ve seen a lot of firewall engineers who could put any auditor into their place, due to their extremely proficient technical skills), I am stating the underlying cost behind the position, which is why PCI-DSS is priced at a rate that’s comparable to say, CMMI, as opposed to say, the ISO9001.

On top of just auditing cost, QSAs take into account the actual support they are giving year on year. Some of them unburden this cost to partners and consultants who have been trained (such as PKF – and there are also other matters such as independence of audit vs implementation advisory which we will discuss later), or some of them take it upon themselves. But you must know the QSAs job is not easy. Aside from auditing and supporting, there is evidence validation and report writing. Then there is the matter of undergoing the Quality Assurance process, which brings more resources/cost to the QSA company. All this while travelling to and from audit sites, reviewing etc – the life of a QSA (ask any QSA) is itinerant and often travel heavy. Burnout may also be a concern, so if the QSAs are involved in the day to day or week to week assistance to their client’s PCI program, this isn’t sustainable.

Understanding all these underlying cost will allow the procurement or whoever is evaluating to understand how to look at projects. If a QSA is pricing extremely low, the question you will need to ask is: What’s being offered? Because all QSAs have more or less the same baseline cost and if a QSA priced themselves at RM800 per man day, and they are a small shop with less than 5 QSAs, what would then be their recovery rate? 200 man days of engagement to recover their initial cost? Most procurement wouldn’t think of things like this and they would just go to their “BAFO” Best and Final Offering – but when you break it down on what is expected, then you would understand that not all PCI offerings are the same. I could simply quote a client 3 man days of QSA work for the final audit and be done. That would be the best and final offering that would win. But what about the healthchecks, the management of the evidences and how they are submitted, the quality checking, the scope optimisation process, the controls checking etc etc?

And in line with our effort estimation, one should also split the pricing into two: Audit and Consultation vs Implementation service and products.

Because if let’s say we find your Requirement 10 is completely empty, and you are thinking to purchase a QRadar SIEM to address it, you could be looking upwards of RM60,000 just to get the product in. Couple that with training for engineers, usage, hiring etc, and you are well over the six figure stage just for Requirement 10! How about testing and application reviews? If you don’t have the personnel on this, then you have to consider setting aside another RM50K etc depending on how many applications/mobile applications/ systems you have in place. So it’s highly essential to have the QSA/consultant assist you in scope reduction. Most may not view it that way, so it’s essential to find an auditor who is experienced and who looks after your interest.

Finally, understand that cost of audit/consulting would be different depending on how you go through PCI-DSS. Level 1 certification requires the effort of validating evidences, doing gap assessments and auditing and writing the RoC. Level 2 SAQ with QSA signoff is slightly easier, as there is no RoC to write while the last option of self signed SAQ without QSA is obviously a lot less costly as you are basically doing a self-signoff. Those are just broad guidelines and not how QSAs may price it, because as I say, due to variables.

You could opt to use the rule of 1/3 when it comes to estimating these costs, although your mileage may vary. For instance, if the QSA throws a RM100K audit fees (comparing it to CMMI fees) for a Level 1 Certification, then a RM60-65K (2/3 of the Level 1) for a SAQ Signoff could be reasonable; and furthermore if you just need them in for consultancy for the non QSA signoff SAQ, it could be 30K (1/3 of the level 1) or so. But note, the SAQ self signoff can be carried out entirely on your own, so the cost could be close to zero as well.

I know its a tough one to place this as pricing varies so often. We aren’t selling a product with specific hardware/software. We are selling a service that will take you through 6 months of work to cover scoping exercise, project meetings, changes, consultancy and advisory, pre-audits and post audits checks, evidence and artefacts sample validations, audit, report writing, training and all the variables in between.

Let us know if you need us to look at your PCI today, drop us a note at pcidss@pkfmalaysia.com and we will attend to you immediately!